The question of whether buying property in Spain is a good investment is more nuanced than ever. Online, you’ll find a confusing mix of travel-blog enthusiasm and cautionary tales of bureaucratic nightmares.

For a discerning UK or US investor in 2025, a clear-eyed, data-driven perspective is essential. This is not a tourism guide; it is a professional analysis designed to answer one question: does a Spanish property investment make financial sense for you?

This guide moves beyond the national averages to focus on the prime investment corridor of the Costa del Sol. We will dissect the market performance, uncover the real costs and tax obligations, and address the specific challenges and opportunities facing non-EU buyers today.

We will provide the practical steps and expert insights needed to turn a complex foreign purchase into a secure and profitable asset.

To be direct: yes, Spanish property continues to be an excellent investment, if you approach it with the right strategy and expertise.

While the frantic post-pandemic boom has cooled, the market has entered a phase of stable, sustainable growth. For savvy investors, this stability presents a prime opportunity.

The key drivers for 2025 and beyond remain robust: sustained demand from international buyers, strong rental yields fuelled by tourism and a growing “work-from-anywhere” population, and an unbeatable lifestyle that underpins the long-term value of any asset.

The focus, however, has sharpened.

The greatest returns are now found not just anywhere in Spain, but in resilient, high-demand enclaves like the Costa del Sol.

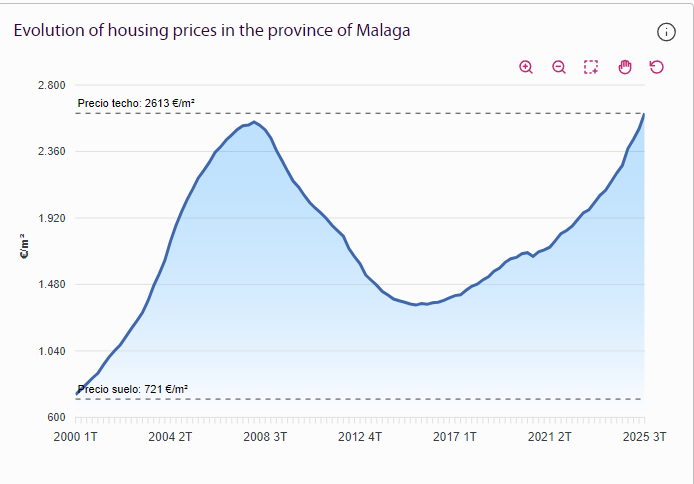

The era of speculative double-digit growth has been replaced by healthy, predictable appreciation. According to the latest data from Spain’s National Statistics Institute (INE), property prices in the Málaga province saw a year-on-year increase of 6.2% in Q2 2025, outpacing the national average.

his is underpinned by a classic supply-and-demand imbalance: the demand for high-quality, modern properties from international buyers continues to outstrip the available supply, putting consistent upward pressure on prices.

For buy-to-let investors, the Costa del Sol is a powerhouse. It is crucial, however, to distinguish between two models:

For non-EU citizens, a property purchase has long been a strategic component of a residency plan. However, it is crucial for investors to be aware of a major policy change in 2024/2025.

The Discontinuation of the Golden Visa for Property Investment

The well-known “Golden Visa” programme, which granted residency for a €500,000 property investment, has been discontinued by the Spanish government to curb property speculation. This means that property purchase alone is no longer a direct route to residency via this specific scheme. Any advice suggesting otherwise is now outdated.

This policy shift has simply refocused attention on other excellent residency pathways that align with modern work and lifestyles. For many of our UK and US clients, these are now the primary, most effective options:

The Digital Nomad Visa (DNV): This is an increasingly popular route for non-EU citizens who can work remotely. If you own a business (e.g., in the UK) or are employed by a company outside of Spain, this visa allows you to live in the country while earning your income from abroad. It’s a perfect fit for today’s flexible work culture. Owning a property here can significantly strengthen your application by demonstrating your commitment and stability in Spain.

The Non-Lucrative Visa (NLV): This remains the ideal pathway for retirees or individuals with sufficient passive income (from pensions, dividends, investments, etc.). While it doesn’t permit you to work in Spain, it is a straightforward route to long-term residency. As with the DNV, proving you have a stable home, such as a property you own, is a major advantage for a successful application.

Investment in the Costa del Sol is about more than bricks and mortar.

You are buying into a region with a thriving economy, world-class infrastructure including Málaga International Airport, and a lifestyle that is second to none.

This “lifestyle ROI” ensures your property remains in high demand from a global audience, protecting its value for years to come.

Beyond traditional lets, the Costa del Sol is becoming a hub for high-value niche markets.

The demand for wellness retreats and luxury properties catering to the growing digital nomad community is surging.

An investment in a property that serves these markets can offer exceptional returns.

Not all locations are created equal. Choosing the right area is critical for maximising your return on investment.

A smart investment requires a clear understanding of the risks. Here are the realities of the Spanish market and how to navigate them.

The process is undeniably complex.

From securing your NIE number to dealing with the notary and land registry, each step is governed by strict procedures.

A small mistake in paperwork can cause lengthy delays or legal issues.

This is not a process to be attempted without expert legal guidance.

It’s critical to budget for costs beyond the property’s ticket price. Expect to pay an additional 10-13% on top. This is comprised of:

UK citizens are now non-EU residents and subject to the 90/180-day rule for stays in the Schengen Area.

Living in Spain full-time requires a residency visa.

Furthermore, non-residents face different tax implications on rental income and capital gains.

Read our special article on selling a house in Spain after Brexit or buying a house in Spain after Brexit.

Your investment requires ongoing management.

This includes community fees (comunidad), local property taxes (IBI), utility bills, and insurance.

For rental properties, a professional management company is essential for handling bookings, maintenance, and guest services, typically charging 15-20% of the rental income.

These challenges are precisely why you need an expert team on the ground. Our legal partners at PCC Legal handle the entire administrative process, from tax calculations to contract reviews, ensuring a transparent and secure transaction.

Joanne Wilson - Head of PCC Property

How much tax do you pay when buying a property in Spain?

Expect to pay between 10% and 13% of the purchase price in total taxes and fees. The largest component is the Property Transfer Tax (ITP), which is a regional tax.

Can I live in Spain permanently if I buy a property?

No, buying a property does not automatically grant residency for non-EU citizens.

However, it is a key requirement for applying for residency visas like the olden Golden Visa or the current Non-Lucrative Visa.

Are Brits still buying property in Spain?

Absolutely.

British buyers remain one of the largest groups of foreign investors in Spain. The process is now different due to Brexit, but with the right legal and financial advice, it remains a very popular and achievable goal.

What is the best investment in Spain right now?

Properties in prime coastal locations like the Costa del Sol that cater to both the luxury long-term rental market and high-season tourism offer the best balance of capital appreciation and strong rental income.

So, is property in Spain a good investment? The data for 2025 indicates a clear yes, but with a critical condition: success is determined not just by what you buy, but by how you buy it. The potential for strong rental yields and capital appreciation on the Costa del Sol is undeniable, yet the path is laden with administrative complexities that can erode returns if not managed by experts.

The process might seem daunting, but this is precisely where our integrated expertise becomes your greatest asset. Navigating this landscape successfully requires a synchronised approach:

A Spanish property is more than just an asset; it’s an entry into a new regulatory and financial system. By engaging with us, you are not just hiring a real estate agent; you are retaining a dedicated team of property, legal, and wealth management professionals committed to safeguarding your investment from start to finish.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Curabitur nulla lectus, tempor sit amet leo a, tristique cursus tortor. In vel dui nisi. Nulla quis mi eget metus convallis posuere vel quis eros.

Check out our detailed area guides along the Costa del Sol and Algarve.

Keep up to date with property news along the Costa del Sol with our blogs.

At PCC Property we don’t just list properties, we unlock lifestyle dreams, Discover how our sales-only, lifestyle-first approach is different.

Who we are

Discover more on our commitment to transparency, trustworthy advice and delivering exceptional client service.